We have all seen it countless times before: a hot new technology captures the tech world’s imagination and a handful of companies succeed in the gold rush. But thousands crash hard when the industry – overhyped by VCs, media, and starry-eyed founders – gets too excited about the space. Here are just a few examples over the past 30 years:

- 1990-2000: Web-based startups; E-commerce sites like Amazon and eBay; Search engines like Yahoo! and AltaVista

- 2001-2010: Social media platforms like Friendster, MySpace, and LinkedIn; Mobile technology and smartphones; Cloud computing services like AWS

- 2011-2015: Big data analytics and business intelligence AI and machine learning gain momentum; Sharing economy companies like Uber, Airbnb, Lyft

- 2016-2020: Blockchain and cryptocurrency; Internet of Things and connected devices; Digital health; Remote work and collaboration tools; Sustainable tech for renewable energy; AR/VR startups expand functionality

- 2021-2022: Quantum computing emerges but still in its infancy; Robotics and drones; Neurotechnology and brain-computer interfaces

- 2023-2025: Generative AI; Commercialization of quantum computing; Robotics and automation, bioengineering and synthetic biology startups emerge

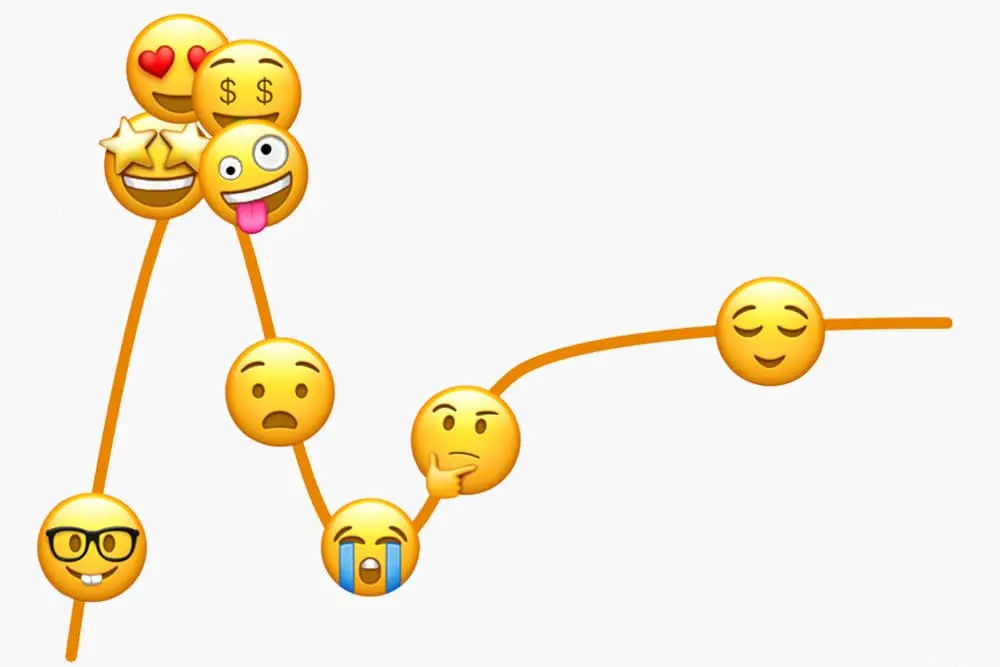

The tech world is surprisingly cyclical and follows a boom-and-bust cycle known as the Gartner Hype Cycle, which poses unique challenges for startups that join the gold rush.

I estimate that about 80% of the startups that I’ve encountered this year want to, or have pivoted into integrating AI tools into their products. Whereas two years ago, about 80% were exploring how the blockchain might add value.

The Hype Cycle tracks the maturity and adoption of new technologies over 5 key phases:

- Innovation Trigger – A breakthrough kicks things off. Media picks up on early stories and proof-of-concepts. Hype and interest builds rapidly.

- Peak of Inflated Expectations – The frenzy hits its highest point. Hype and excitement lead to inflated projections and unrealistic expectations about how fast the tech will take off.

- Trough of Disillusionment – Interest wanes as experiments fail to deliver. Investments dry up. Producers consolidate or fail.

- Slope of Enlightenment – Benefits become clear as the technology matures. Mainstream adoption begins. Standards emerge.

- Plateau of Productivity – Widespread adoption is achieved. The technology becomes stable and delivers real value.

While I believe that the current iteration of AI will prove to be more impactful than the Internet, we are still in the “Innovation Trigger” phase. So, most startups entering the current gold rush are destined to succumb to hype, and fail.

Here are three key strategies that AI startups should employ to survive the turbulence.

The below guidance is for startups entering the space during the Hype Cycle, not the ones already embedded in the space before it began.

Work in stealth mode as long as possible

When any new technology reaches the Peak of Inflated Expectations stage, there is immense pressure to rush your product to market to capitalize on the hype. While the urge is understandable, it is often disastrous.

AI startups should resist the temptation to launch before their product is truly ready. No matter how much hype AI generates, releasing an underdeveloped product will only lead to disillusionment down the line.

Your AI startup should work in stealth mode for as long as it takes to get the technology right. Once the AI system is thoroughly tested and ready for primetime, then consider launching.

Focus on building a profitable business

Growth fueled by raising enormous funding rounds makes sense with other startup business models. With AI, however, unless you are an established player when the hype passes the VC funding will dry up.

The VCs will quickly move on to the next hyped-up technology and your startup will fail. As the famous financial adage goes, “If you see a bandwagon, it’s too late.” Just ask any crypto startup founder.

If you are entering in the middle of the Hype Cycle, I recommend relentlessly focusing on building a profitable business model from the start and not rely on fickle investor funding.

Avoid chasing AI side trends

As AI advances, side trends will emerge as some applications gain more mainstream traction than others. AI startups, or those that pivot into AI, may be tempted to abandon their core vision to jump on the latest craze.

But continually pivoting to chase AI side trends is a mistake. Almost all supposed “killer apps” have historically been a “flash in the pan.” The AI startups that survive are those that stick to solving a real-world problem with AI in a sustainable way.

The AI Hype Cycle is in full swing, and history has shown over-and-over that what goes up eventually comes crashing down. While AI offers tremendous promise, the vast majority of startups caught up in the hype will fail once reality sets in.

If you are in AI, or considering getting into AI, keep in mind that the hype will soon fade, but AI’s immense promise and opportunity will endure. If you play the long game you will eventually have the power to transform entire industries – but you need to survive the cycle first.